I have been absent from the blog scene for personal reasons. But, I continue to participate in the coin market, and have been observing the shifts underway in the market for early copper coins. A few of my observations are summarized as follows:

> The coin market (in general) continues to mark time. Coin collectors have learned to be patient. The opportunity to acquire a truly rare coin always trumps the circumstances of the current market ups & downs. Generic material remains very weak. However, marquee coins continue to sell at reasonable prices (bargains, one might possibly argue). There are a number of forces exerting influence on the coin market today. Uncertainty is high, due to both economic and political factors. The overall economy, while appearing strong on the surface, faces a number of headwinds. Interest rates, energy prices, currency values are all at historically high levels of volatility. A long bull market in equities faces an uncertain future. Gold remains stable (?) at 2-year old levels. A break-out feels imminent.

> Coin collecting is faced with an additional worry - the demographic challenge. The old guard is beginning to liquidate, and newcomers to copper are less inclined to follow the old ways. Full sets, by Sheldon or Newcomb # are no longer in vogue. There are so many other collecting themes to consider - die-state collecting, date-specific, RED BOOK sets, error collections. This is challenging the traditional models for value. R5 once represented a desirable coin (population less than 75). but, what if only 50 people find themselves wanting one? Well.... there will be fewer bidders. That is the new reality. But, what if a new terminal die-state is found for an R1 variety: now, THAT is interesting! This is how it has always been with collecting. The shift is neither new nor should it be surprising.

> GRADING! This is a subject that could fill a book. Since 1986, we have witnessed the era of the third-party-grading service (TPG). There is no denying the success of the TPG, as a business. What about the success from the perspective of the coin hobby? Well, in fairness, there have been some positive developments: Authentication, as part of the TPG service, has gone a long way to remove counterfeit & altered coins from the market place. Certification has also created value in the form of "perceived good" coins (ie. coins that the services deem fit for numerical grades). The "bad" coins (those deemed unfit by the grading services, and given "details" grades) have suffered a great deal of persecution in the marketplace. Is this fair? That depends upon your perspective of the role of the TPG. They have become the "arbiters" of good & bad in the coin marker. Those willing to accept the judgement of the TPG hold the products of that judgement. Those willing to think on their own may hold some questionable (?) coins. One day, when the third-party grading paradigm is discarded, these questionable items may find increased market acceptance. When might this occur? Probably not soon enough to save today's owners. But, the coin market is ultimately rational, and the time will come when rarity & condition (in the absolute sense) will prevail over "condition rarity" (as defined by population reports). This is (admittedly) an optimistic scenario for the triumph of logic over propaganda. Time will tell whether it is an accurate forecast.

> What about coin collecting? Will it survive the transition to a "cashless" society? We have witnessed the steep decline in stamp collecting. That should send a collective chill up the spines of today's coin collectors. Most of the stamps collected over the past 50 years are best licked and used to send out letters today! Could this also happen to coins? Well, in some cases, YES! Those double albums of statehood quarters, culled from circulation, are doomed to the tip jars of the world. The fate should be different for the classic coins from the 18th & 19th century. The abandonment of coinage in the U.S. might actually lead to a resurgence of interest in classic old coins. Rarity and history might combine to create a virtuous cycle for collectors of classic U.S. coinage. Again, I admit to a touch of romanticism and optimism combined. But, I hope I am right!

Tuesday, September 26, 2017

Sunday, April 16, 2017

A little note about Numismatic Literature

I recently made the acquaintance of a young man who works at a local business, and he expressed an interest in coins after learning that I am an avid collector. Lately, each time I see this fellow, he either asks me what I have that is "new", or he entertains me with a story of some numismatic item that he found.

I remember being surprised by his interest, since I thought that everyone his age was infatuated with high-tech "toys", and had no interest in "old school" hobbies like collecting. I decided to try to inspire this kid, by gifting a few numismatic books to him.

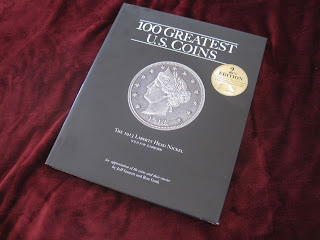

The first gift was the modern classic "100 Greatest U.S. Coins" by Jeff Garrett and Ron Guth. I just happened to obtain a duplicate copy of the 2nd edition, and the intent of the gift was "shock & awe", at both the beauty and the value of some of our finest coins.

Next, after we had a discussion about mint-marks on Mercury dimes, I gave the young man two different books. First, an early edition of "A.N.A. Grading Standards" (I purchased a newer edition for my own use). Second was an earlier edition of "The Cherrypicker's Guide To Rare Die Varieties" by Bill Fivaz and J.T. Stanton. These two books have a lot of practical value for a new numismatist.

I began to reminisce about my own beginnings with numismatic literature.

My interest in U.S. coins began to stir in the late 1980's. I occasionally visited the retail coin shop of Steve Estes PN. Steve kept a stock of coin books for sale, and the first one I spent real money for was another classic: "The History of United States Coinage as Illustrated by the Garrett Collection" written by Q. David Bowers, who is one of the preeminent numismatists of our time (and a prolific author) . Dave wrote this book as a tribute to the famous Garrett family collection at the time of the collection's sale (by his firm, Bowers & Ruddy). The collection had been donated by the Garrett family to the Johns Hopkins University in Baltimore, MD, and board of Johns Hopkins made the decision to sell.

This volume remains one of the keystones to my numismatic library, and I can still recommend it as a good way to learn about U.S. coinage and one of America's earliest and most devoted collectors, T. Harrison Garrett. I remember being enthralled by the image of the Garrett family home (known as Evergreen House) in north Baltimore, and the thrill of actually visiting Evergreen House and taking the tour over 15 years later.

My next big numismatic literature purchase was "Walter Breen's Complete Encyclopedia of U.S. and Colonial Coins". As the title implies, this was an ambitious effort to cover (in great detail) the colonial coinage of the early U.S. (ie. prior to the establishment of the U.S. Mint and commencement of coin production in 1793), all the regular-issue U.S. coinage (plus proof and commemorative issues), and even much of the private & territorial coins of the U.S. Breen supplemented his encyclopedic understanding of each series with amusing (and occasionally factual) anecdotes concerning the production and/or the collecting of particular coinage issues. Breen's work covered the important types for each series, while leaving the exhaustive variety-by-variety analysis to other authors. By that time, I had become involved in collecting large cents, and it was Breen who informed me about some of the important cent hoards and accumulations (eg. The Nichols Find and the Randall Hoard) and the fact that some coins are important enough to have names of their own (eg. "THE COIN", which refers to a particular 1793 Chain Cent).

I remember being surprised by his interest, since I thought that everyone his age was infatuated with high-tech "toys", and had no interest in "old school" hobbies like collecting. I decided to try to inspire this kid, by gifting a few numismatic books to him.

The first gift was the modern classic "100 Greatest U.S. Coins" by Jeff Garrett and Ron Guth. I just happened to obtain a duplicate copy of the 2nd edition, and the intent of the gift was "shock & awe", at both the beauty and the value of some of our finest coins.

Next, after we had a discussion about mint-marks on Mercury dimes, I gave the young man two different books. First, an early edition of "A.N.A. Grading Standards" (I purchased a newer edition for my own use). Second was an earlier edition of "The Cherrypicker's Guide To Rare Die Varieties" by Bill Fivaz and J.T. Stanton. These two books have a lot of practical value for a new numismatist.

I began to reminisce about my own beginnings with numismatic literature.

My interest in U.S. coins began to stir in the late 1980's. I occasionally visited the retail coin shop of Steve Estes PN. Steve kept a stock of coin books for sale, and the first one I spent real money for was another classic: "The History of United States Coinage as Illustrated by the Garrett Collection" written by Q. David Bowers, who is one of the preeminent numismatists of our time (and a prolific author) . Dave wrote this book as a tribute to the famous Garrett family collection at the time of the collection's sale (by his firm, Bowers & Ruddy). The collection had been donated by the Garrett family to the Johns Hopkins University in Baltimore, MD, and board of Johns Hopkins made the decision to sell.

This volume remains one of the keystones to my numismatic library, and I can still recommend it as a good way to learn about U.S. coinage and one of America's earliest and most devoted collectors, T. Harrison Garrett. I remember being enthralled by the image of the Garrett family home (known as Evergreen House) in north Baltimore, and the thrill of actually visiting Evergreen House and taking the tour over 15 years later.

My next big numismatic literature purchase was "Walter Breen's Complete Encyclopedia of U.S. and Colonial Coins". As the title implies, this was an ambitious effort to cover (in great detail) the colonial coinage of the early U.S. (ie. prior to the establishment of the U.S. Mint and commencement of coin production in 1793), all the regular-issue U.S. coinage (plus proof and commemorative issues), and even much of the private & territorial coins of the U.S. Breen supplemented his encyclopedic understanding of each series with amusing (and occasionally factual) anecdotes concerning the production and/or the collecting of particular coinage issues. Breen's work covered the important types for each series, while leaving the exhaustive variety-by-variety analysis to other authors. By that time, I had become involved in collecting large cents, and it was Breen who informed me about some of the important cent hoards and accumulations (eg. The Nichols Find and the Randall Hoard) and the fact that some coins are important enough to have names of their own (eg. "THE COIN", which refers to a particular 1793 Chain Cent).

Tuesday, February 21, 2017

Goldbergs Feb. 2017 Pre-Long Beach sale - Auction Commentary

The Goldbergs held their traditional pre-Long Beach copper auction on Sunday Feb. 12 at the Intercontinental Hotel in L.A. The ballroom was full, but not overcrowded, and the bidding was lively, even though the pace of the action was slow (about 40 lots / hour).

There were five coin collections to sell: 1. The Haig Koshkarian Red Book Large Cent Set. 2. Tom Reynolds Part-2 Large Cents. 3. The Chuck Heck 1794 Large Cent Set. 4. The Pierre Fricke Color Set of Large Cents. and 5. The Bruce Tucker Collection.

The question in my mind, going into this sale, was whether the copper market could shake off the doldrums that seemed to settle over the market last summer. This auction provided an affirmative answer, but with a few caveats. Allow me to elaborate a little:

The Koshkarian coins were carefully chosen coins of generally high quality. Many of the coins represented rare opportunities for bidders, which can often lead to runaway bidding. This happened from time-to-time during the Koshkarian sale, but not too often. Bidders were selective.

> The first upside surprise was provided by LOT 3, a 1793 Chain Cent (S-4) graded PCGS AU-50 (though only an EAC VF-30). This coin hammered for $140,000 vs. a $65,000 estimate.

> Just two lots later (LOT 5), a 1793 Wreath Cent, lettered edge (S-11c) graded PCGS AU-55 was hammered for $48,000 vs. a 75,000 estimate. A real bargain considering this very coin sold for $92,000 in 2011!

> Two lots later (LOT 7) a rather attractive 1794 Hd. of 93 Cent (S-20b / R5) hammered for just $20,000 vs. an estimate of $30,000. Here, the reason appears to be the PCGS "Genuine" holder. Almost every coin that PCGS did not deem gradeable was punished mercilessly by the bidders.

> The next upside surprise was LOT 21. A very attractive 1797 Draped Bust Cent with Rev. of 1795 (S-120a) graded PCGS AU-58 was bid to $70,000 vs. an estimate of only $18,000! I suspect PCGS registry set bidders in this case.

> The Koshkarian 1804 cent (LOT 50, S-266c) (PCGS AU-55) brought a winning bid of $165,000 vs. an estimate of $45,000. A strong price for the 2nd-finest PCGS-graded coin.

> LOT 58, a very nice 1807 S-276 graded PCGS MS-62 was bid all the way to $95,000 vs. the estimate of $10,000. The hammer price defies explanation.

> The Koshkarian 1826/5 N-8 cent, graded PCGS MS-64 went for a hammer of $23,000 vs. an estimate of $7500. A remarkable price for a really nice coin.

> LOT 127, an 1844/81 N-2 cent graded PCGS MS64 RB was hammered for $65,000 (estimate was $25,000). The result is not surprising for the finest-graded coin of a popular overdate variety.

The Reynolds coins were basically everything "left over" after Reynolds part-1, which was held at the same place a year earlier. Naturally, there were still a few nice coins in this sale; but the marquee coins were sold a year ago.

> LOT 174 provided the first upside surprise of the Reynolds coins. This beautiful 1798 S-167 cent graded PCGS AU-58 carried a pre-sale estimate of $5000 and hammered for $27,000! I will admit that the coin was indeed a beauty.

> The 1800 NC-4 cent in the Reynolds collection (LOT 197, graded G4 by PCGS) was bid to $11,000 vs. an estimate of $2000. A case of a very conservative estimate.

> LOT 225 in the Reynolds sale was an 1805 S-267 graded PCGS MS-65BN hammered at $44,000 vs. the estimate of just $15,000. I should note that this coin is also listed as CC#1 in the Noyes EAC census for the variety.

The Chuck Heck collection was an entirely different kind of sale from the previous two collections. The Heck coins were virtually all "raw" coins (no slab grades), and this auction was a collector-to-collector sale. The energy and enthusiasm that greeted the Heck coins was an encouraging sign to me. It convinced me that there are still people out there interested in owning nice coins (with or without the slab). The prices exceeded expectations nearly across the board. Notable coins included:

> LOT 273 was the famous Chuck Heck Sheldon-37, with a provenance extending back to 1910. This lot was bid with enthusiasm to $100,000 (estimate was $40,000).

> LOT 292 was a 1794 Starred Reverse Cent (S-48) graded PCGS G-6 (the holder needed more for authenticity than grade). The hammer fell at $25,000 (vs. estimate of $12,000).

The Pierre Fricke color set met my expectations. There were not too many surprises among these lots.

> LOT 384 was one exception. This beautiful 1821 N-1 cent graded AU58+ by PCGS got bid all the way to $12,500 (estimate was $4000). I admit I liked this coin a lot, and would have been happy to own it (just not at the price it ultimately realized).

The Bruce Tucker collection contained a lot of nice coins, but not a lot of outstanding rarities. The collection came up very late in the sale, but I do not believe the prices suffered much as a result. There were still many internet bidders on-line at this hour, and these folks might have been shut out by floor bidders on the earlier material. At any rate, the Tucker coins sold at very reasonable levels.

There were five coin collections to sell: 1. The Haig Koshkarian Red Book Large Cent Set. 2. Tom Reynolds Part-2 Large Cents. 3. The Chuck Heck 1794 Large Cent Set. 4. The Pierre Fricke Color Set of Large Cents. and 5. The Bruce Tucker Collection.

The question in my mind, going into this sale, was whether the copper market could shake off the doldrums that seemed to settle over the market last summer. This auction provided an affirmative answer, but with a few caveats. Allow me to elaborate a little:

> The first upside surprise was provided by LOT 3, a 1793 Chain Cent (S-4) graded PCGS AU-50 (though only an EAC VF-30). This coin hammered for $140,000 vs. a $65,000 estimate.

> Just two lots later (LOT 5), a 1793 Wreath Cent, lettered edge (S-11c) graded PCGS AU-55 was hammered for $48,000 vs. a 75,000 estimate. A real bargain considering this very coin sold for $92,000 in 2011!

> Two lots later (LOT 7) a rather attractive 1794 Hd. of 93 Cent (S-20b / R5) hammered for just $20,000 vs. an estimate of $30,000. Here, the reason appears to be the PCGS "Genuine" holder. Almost every coin that PCGS did not deem gradeable was punished mercilessly by the bidders.

> The next upside surprise was LOT 21. A very attractive 1797 Draped Bust Cent with Rev. of 1795 (S-120a) graded PCGS AU-58 was bid to $70,000 vs. an estimate of only $18,000! I suspect PCGS registry set bidders in this case.

> The Koshkarian 1804 cent (LOT 50, S-266c) (PCGS AU-55) brought a winning bid of $165,000 vs. an estimate of $45,000. A strong price for the 2nd-finest PCGS-graded coin.

> LOT 58, a very nice 1807 S-276 graded PCGS MS-62 was bid all the way to $95,000 vs. the estimate of $10,000. The hammer price defies explanation.

> The Koshkarian 1826/5 N-8 cent, graded PCGS MS-64 went for a hammer of $23,000 vs. an estimate of $7500. A remarkable price for a really nice coin.

> LOT 127, an 1844/81 N-2 cent graded PCGS MS64 RB was hammered for $65,000 (estimate was $25,000). The result is not surprising for the finest-graded coin of a popular overdate variety.

> LOT 174 provided the first upside surprise of the Reynolds coins. This beautiful 1798 S-167 cent graded PCGS AU-58 carried a pre-sale estimate of $5000 and hammered for $27,000! I will admit that the coin was indeed a beauty.

> The 1800 NC-4 cent in the Reynolds collection (LOT 197, graded G4 by PCGS) was bid to $11,000 vs. an estimate of $2000. A case of a very conservative estimate.

> LOT 225 in the Reynolds sale was an 1805 S-267 graded PCGS MS-65BN hammered at $44,000 vs. the estimate of just $15,000. I should note that this coin is also listed as CC#1 in the Noyes EAC census for the variety.

> LOT 273 was the famous Chuck Heck Sheldon-37, with a provenance extending back to 1910. This lot was bid with enthusiasm to $100,000 (estimate was $40,000).

> LOT 292 was a 1794 Starred Reverse Cent (S-48) graded PCGS G-6 (the holder needed more for authenticity than grade). The hammer fell at $25,000 (vs. estimate of $12,000).

> LOT 384 was one exception. This beautiful 1821 N-1 cent graded AU58+ by PCGS got bid all the way to $12,500 (estimate was $4000). I admit I liked this coin a lot, and would have been happy to own it (just not at the price it ultimately realized).

Friday, January 20, 2017

Beyond the Yellow Brick Road

Happy New Year to all fans of coins, and especially to fans of early copper coins! I am excited about the collecting year ahead of us. The past year saw rare coin prices languish somewhat, but there are reasons to be optimistic. For one, there is a large auction of copper coming in early Feb. The Goldbergs have announced the sale of four large collections on a single day. Later, the Pogue Collection (Part-V) is scheduled at Stacks / Bowers. Records could fall!

In other coin news, I just happened to be on-line watching the recent Heritage Auctions internet session, and I witnessed something that altered my understanding of the rare coin market: A 2004 Texas statehood quarter, graded NGC MS-69 was sold for $3055! That is NOT a typo. No, I did not forget to put the decimal point into that price. A single statehood quarter sold for Three Grand! The coin was part of a NGC Registry Set collection known as "The Mile High Collection". Now, for the really astounding part - this was not the highest price for a statehood quarter from this collection. A 1999 Pennsylvania quarter (also NGC MS-69) sold for $7050! WOW!

You can find the entire Mile High Collection auction at the Heritage web site. I will provide a link here:

Mile_High_Collection_Heritage

The prices realized by these statehood quarters are a surprise to me because: 1. I do not collect this series. Therefore I do not really know how to grade the coins, or what the appropriate values should be. 2. I do collect early copper coins (half cents & large cents), and I have a pretty good idea of what can be purchased for $3000 in these categories (you can get something really NICE for $3K). 3. The statehood quarters are (for the most part) 21st-century U.S. coins, so they are plentiful. I believe there are many rolls of such coins (in uncirculated condition) sitting in desk drawers. 4. The MS-69 coins which sold for so much money are so-called "condition rarities". However, a huge overhang of "ungraded" coins is out there. If/when these are certified, the populations of these higher grade ranges can be radically increased. Would someone be willing to pay $3000 for a 2004 Texas quarter in MS-69 if they knew the population was 100, rather than 1? I would think not.

I urge you to consider your own collecting / investing strategy. Are you buying coins for pleasure or profit (or both)? Are you spending hundreds (or thousands) of dollars per coin? Are you buying coins that have proven rarity, or are you buying low population modern coins (according to the grading service pop reports)? Have fun, but be careful!

In other coin news, I just happened to be on-line watching the recent Heritage Auctions internet session, and I witnessed something that altered my understanding of the rare coin market: A 2004 Texas statehood quarter, graded NGC MS-69 was sold for $3055! That is NOT a typo. No, I did not forget to put the decimal point into that price. A single statehood quarter sold for Three Grand! The coin was part of a NGC Registry Set collection known as "The Mile High Collection". Now, for the really astounding part - this was not the highest price for a statehood quarter from this collection. A 1999 Pennsylvania quarter (also NGC MS-69) sold for $7050! WOW!

You can find the entire Mile High Collection auction at the Heritage web site. I will provide a link here:

Mile_High_Collection_Heritage

The prices realized by these statehood quarters are a surprise to me because: 1. I do not collect this series. Therefore I do not really know how to grade the coins, or what the appropriate values should be. 2. I do collect early copper coins (half cents & large cents), and I have a pretty good idea of what can be purchased for $3000 in these categories (you can get something really NICE for $3K). 3. The statehood quarters are (for the most part) 21st-century U.S. coins, so they are plentiful. I believe there are many rolls of such coins (in uncirculated condition) sitting in desk drawers. 4. The MS-69 coins which sold for so much money are so-called "condition rarities". However, a huge overhang of "ungraded" coins is out there. If/when these are certified, the populations of these higher grade ranges can be radically increased. Would someone be willing to pay $3000 for a 2004 Texas quarter in MS-69 if they knew the population was 100, rather than 1? I would think not.

I urge you to consider your own collecting / investing strategy. Are you buying coins for pleasure or profit (or both)? Are you spending hundreds (or thousands) of dollars per coin? Are you buying coins that have proven rarity, or are you buying low population modern coins (according to the grading service pop reports)? Have fun, but be careful!

Subscribe to:

Posts (Atom)